Unduh Aplikasi

-

- Platform Perdagangan

- Aplikasi PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Sosial

-

- Kondisi Perdagangan

- Jenis Akun

- Spread, Biaya & Swap

- Setoran & Penarikan

- Biaya & Biaya

- Jam Perdagangan

Unduh Aplikasi

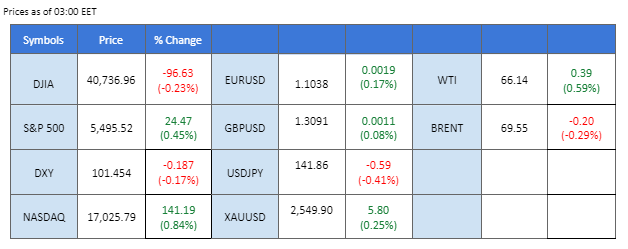

Market Summary

Ahead of the highly anticipated U.S. CPI data release today, which the market is closely watching for clues on the Fed’s upcoming monetary policy moves, Wall Street remained largely unchanged in the previous session. The dollar index (DXY) faced rejection below the $102 mark, signalling that expectations of a Fed rate cut are weighing on the dollar’s strength.

The Japanese Yen emerged as one of the strongest currencies, buoyed by signals from Bank of Japan (BoJ) officials pointing toward further monetary tightening. This propelled the yen to its strongest level against the U.S. dollar in 2024. Additionally, the BoJ’s reduction in debt purchases is expected to raise bond yields, further boosting the yen’s strength.

In Australia, the RBA deputy governor noted the limited impact of monetary tightening so far, while acknowledging a persistently tight labour market. This suggests the Aussie dollar may see gradual strengthening as the RBA maintains its current policy stance.In the commodity markets, gold rose near its all-time high, driven by the likelihood of a Fed rate cut. A higher high price pattern has formed, hinting at a potential breakout above the $2,530 resistance level. On the other hand, oil prices dipped below critical support at $67.50, reaching their lowest levels since May 2023 amid a bleak demand outlook.

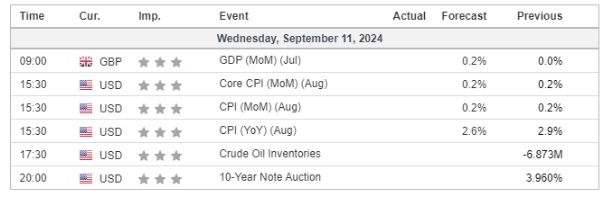

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index traded flat as investors awaited the release of key US inflation data. Market expectations lean toward a 25-basis point rate cut, with 66% of participants expecting this outcome and 34% anticipating a 50-basis point cut. While the smaller rate cut expectations provided slight support to the dollar, the upcoming Consumer Price Index (CPI) report could shift the Federal Reserve’s monetary stance. In the longer term, some analysts predict aggressive rate cuts of up to 105 basis points by the end of the year, casting a negative outlook for the dollar in the long run.

The Dollar Index is trading flat while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 51, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 101.70, 102.35

Support level: 100.55, 99.70

Gold prices saw a sharp rebound but remained in a consolidation phase as investors awaited crucial US inflation data to determine the future trend of the gold market. Additionally, the first presidential debate between Vice President Kamala Harris and former President Donald Trump increased market volatility, prompting a flight to safe-haven assets like gold.

Gold prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2525.00, 2555.00

Support level: 2505.00, 2480.00

The GBP/USD pair has been consolidating after a period of bearish trading since last Friday. A break above the short-term resistance level at 1.3100 could indicate a potential trend reversal for the pair. However, market participants are closely watching today’s U.S. CPI data, which will shape expectations for the Fed’s rate cut decision on September 18th. If the inflation reading surpasses market expectations, it could boost the dollar’s strength, putting further downside pressure on the GBP/USD pair.

GBP/USD has eased from its bearish momentum and found support at the near 1.3060 level. The RSI is climbing upward from above the oversold zone, while the MACD is about to form a golden cross below, suggesting the bearish momentum is easing.

Resistance level: 1.3240, 1.3220

Support level:1.2980, 1.2910

The EUR/USD pair has seen a technical rebound but remains entrenched in its downtrend trajectory. The U.S. dollar has lost strength ahead of today’s CPI reading, as growing expectations for a Fed rate cut have softened the greenback. However, this dynamic is balanced by anticipation of a potential 25 bps rate cut from the ECB on Thursday, which is also weighing on the euro’s strength.

EUR/USD recorded a marginal gain in the last session, but the pair remains trading within a downtrend trajectory, suggesting a bearish bias. The RSI remains close to the oversold zone, while the MACD continues to edge lower, suggesting the pair remains trading with bearish momentum.

Resistance level: 1.1106, 1.1170

Support level: 1.0985, 1.0940

The US equity market rebounded after last week’s decline, driven by investor interest in Apple’s new AI-enhanced iPhones and profit-taking ahead of key inflation reports. The upcoming consumer price index and producer price index for August, scheduled for release on Wednesday and Thursday, respectively, are critical as they will be the last major data points before the Fed meeting on September 18. Investors should watch these reports closely for indications of future market movement.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 39, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 18890.00, 20015.00

Support level: 17865.00, 17115.00

The AUD/USD pair continues to trade in a lower low candlestick pattern, signalling a bearish bias for the pair. Despite this current price action, remarks from the RBA Deputy Governor highlighted that the Australian labour market remains tight compared to full employment, hinting that the RBA may maintain its monetary tightening policy for an extended period to combat inflation. This outlook suggests that the Aussie dollar could strengthen in the near term as the central bank remains committed to controlling inflation pressures.

The pair continues to edge lower after recording a significant plunge last Friday, suggesting that the bearish momentum is overwhelming. The RSI remains at below 50, while the MACD continues to edge lower, suggesting that the bearish momentum remains strong with the pair.

Resistance level: 0.6673, 0.6730

Support level: 0.6610, 0.6550

The USD/JPY pair remains below the fair-value gap and is trading near its lowest level in 2024, indicating a bearish bias for the pair. The Bank of Japan (BoJ) officials have signalled the possibility of further rate hikes, which has bolstered the strength of the Japanese Yen. Meanwhile, the U.S. dollar has been pressured by growing rate cut expectations ahead of the mid-September FOMC meeting, contributing to the continued slide in the pair’s price. If the BoJ continues to tighten its policy, and U.S. rate cut expectations remain, the pair could face further downside pressure.

The pair has once again dropped to its critical support zone and is set to break below that level. A break below will serve as a solid bearish signal for the pair. The RSI is approaching the oversold zone, while the MACD hovers below the zero line, suggesting that the bearish momentum remains strong.

Resistance level: 143.45, 146.00

Support level: 138.90, 137.45

Oil prices extended their losses as a gloomy economic outlook in China and the United States weighed on demand expectations. OPEC lowered its global oil demand growth forecast for 2024, now expecting an increase of 2.03 million barrels per day (bpd), down from the previous forecast of 2.11 million bpd. This marks the second consecutive downward revision. Despite this, OPEC+ plans to increase output in October and November, potentially impacting oil prices further.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 31, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 68.50, 71.80

Support level: 65.35, 62.10

Trading forex, indeks, Logam, dan lainnya dengan spread rendah di bidang ini dan eksekusi secepat kilat.

Daftar Akun Live PU Prime dengan prosedur kami yang tanpa ribet.

Danai akun Anda secara mudah dengan aneka ragam kanal pembayaran dan mata uang yang diterima.

Akses ratusan instrumen dalam kondisi trading terunggul di pasar.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!