Unduh Aplikasi

-

- Platform Perdagangan

- Aplikasi PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Sosial

-

- Kondisi Perdagangan

- Jenis Akun

- Spread, Biaya & Swap

- Setoran & Penarikan

- Biaya & Biaya

- Jam Perdagangan

Unduh Aplikasi

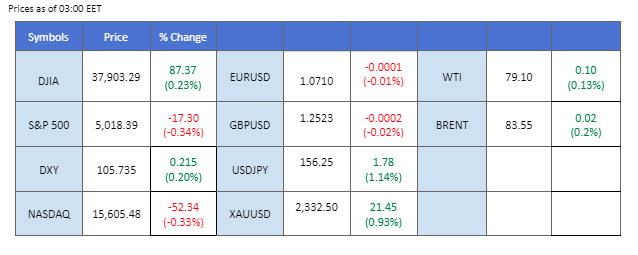

The financial markets were roiled by Jerome Powell’s remarks following the Fed’s interest rate decision announcement. Powell’s dovish stance prompted a sharp decline in the strength of the U.S. dollar, while gold prices rebounded on the prospect of a softer dollar. Despite ongoing signs of inflationary pressures in the U.S, Powell indicated that the central bank is unlikely to pursue further interest rate hikes and may even consider rate cuts later this year.

In tandem with these developments, oil prices tumbled to their lowest levels since March as U.S. stockpiles surged, raising concerns about weakening demand for oil. Meanwhile, the Japanese Yen experienced significant volatility, with the USD/JPY pair oscillating between near 158 and 153 levels against the U.S. dollar over the past 12 hours. While market participants widely speculate that Japanese officials have intervened to stabilise the currency, there has been no official confirmation, leaving investors in the dark and cautious.

Additionally, BTC prices plummeted to nearly $57,000, reaching their lowest levels since February, amid subdued market sentiment. The debut of BTC ETFs in Hong Kong failed to ignite enthusiasm in the crypto market, with limited inflows observed. Moreover, the macroeconomic backdrop, characterised by a high-interest-rate environment, has not favoured the crypto market. To exacerbate matters, Binance CEO CZ Zhao’s guilty plea to money laundering charges has further damaged credibility within the crypto market.

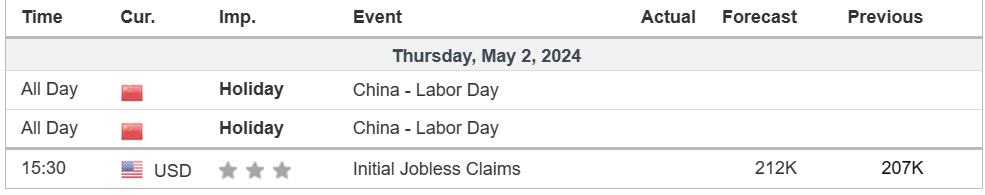

Current rate hike bets on 12th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.2%) VS -25 bps (11.8%)

(MT4 System Time)

Source: MQL5

Following the conclusion of the FOMC meeting, the Dollar Index dipped as investors engaged in profit-taking, investors had digested hawkish expectations from the Federal Reserve. Despite leaving interest rates unchanged, the Fed signalled its inclination toward eventual rate cuts, citing slightly worse-than-expected economic performance. Notably, disappointing data from the JOLTs jobs openings and the US ADP Nonfarm Employment Change reports added to market uncertainties.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 106.35, 107.05

Support level: 105.70, 105.25

Gold prices staged a rebound, propelled by the depreciation of the US Dollar, leading investors to shift their focus towards dollar-denominated gold assets. However, lingering uncertainties loom ahead of major events such as the release of Nonfarm Payrolls, Unemployment Rate, and Average Earnings Index + Bonus. Despite the recent rebound, the future trajectory of gold remains uncertain, urging investors to exercise caution and closely monitor forthcoming US economic data.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 54, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2330.00, 2360.00

Support level: 2300.00, 2270.00

The GBP/USD pair saw a notable rebound driven by fundamental factors following its decline in the previous session. The U.S. dollar experienced a significant drop of over 0.5% following Jerome Powell’s dovish remarks made yesterday. Additionally, the UK PMI reading released yesterday surpassed market expectations slightly, providing further support to Sterling.

The GBP/USD has once again back to its strong resistance level at 1.2540 level. The RSI was supported at above 50 level while the MACD rebounded at above the zero line suggest a potential trend reversal for the pair.

Resistance level: 1.2540, 1.2660

Support level: 1.2440, 1.2370

The EUR/USD pair has rebounded from its weekly low and is now approaching its recent high near 1.0740. The pair’s movement has been primarily influenced by the strength of the dollar, coupled with the dovish remarks made by the Fed’s chief yesterday, which has bolstered bullish sentiment for the pair. Looking ahead, Friday’s Non-Farm Payrolls (NFP) report will likely serve as a crucial determinant for the pair’s direction in the near term.

The pair rebounded strongly from its recent low level, suggesting a potential trend reversal. The MACD has signs of rebounding from above the zero line, while the RSI edged higher from below the 50 level, suggesting fresh bullish momentum may be forming.

Resistance level: 1.0775, 1.0865

Support level: 1.0630, 1.0560

The US equity market experienced mixed performance, with the energy sector facing significant headwinds due to the decline in oil prices. Notably, companies such as Kraft Heinz, Yum! Brands, and Starbucks Corporation reported disappointing earnings, reflecting challenges posed by inflation-weary consumers. Conversely, Pfizer’s stock saw a rise after surpassing first-quarter expectations and boosting its full-year outlook, offering a bright spot amidst broader market uncertainties.

Nasdaq is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 40, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 17850.00, 18430.00

Support level: 16975.00, 16230.00

The USD/JPY pair has exhibited considerable volatility, fluctuating between the 158 to 153 levels over the past 12 hours. This volatility has largely been driven by speculation surrounding potential intervention from Japanese authorities to stabilise the yen, particularly as the currency approached the critical 160 mark. Meanwhile, the dollar experienced notable fluctuations in the last session in response to the Federal Reserve’s statement following the interest rate decision.

The pair recorded a wide fluctuation of more than 500 pips in the last session but is currently back to its previous liquidity zone at near 155.50. The RSI edged lower, while the MACD declined toward the zero line, suggesting that the bearish momentum is overwhelming.

Resistance level: 156.90, 158.35

Support level:155.70, 154.25

Support level: 57060.00, 52530.00

Crude oil prices witnessed a sharp decline, driven by a bearish inventory report and a reduction in Middle East tensions. The Energy Information Administration reported a significant jump in US inventories, with stockpiles surging by 7.3 million barrels, surpassing market expectations. This data indicates a potential oversupply in the oil market. However, prospects of a ceasefire agreement in the Middle East, spearheaded by Egypt, added a layer of uncertainty, necessitating continued vigilance for further trading signals.

Oil prices are trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 30, suggesting the commodity might enter oversold territory.

Resistance level: 80.45, 81.90

Support level: 78.00, 75.95

Trading forex, indeks, Logam, dan lainnya dengan spread rendah di bidang ini dan eksekusi secepat kilat.

Daftar Akun Live PU Prime dengan prosedur kami yang tanpa ribet.

Danai akun Anda secara mudah dengan aneka ragam kanal pembayaran dan mata uang yang diterima.

Akses ratusan instrumen dalam kondisi trading terunggul di pasar.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!